Global markets make sharp rally first week in February.

The week ending February 5th saw global equity markets rally sharply, a steepening yield curve, and a strong bid for USDs and commodities.

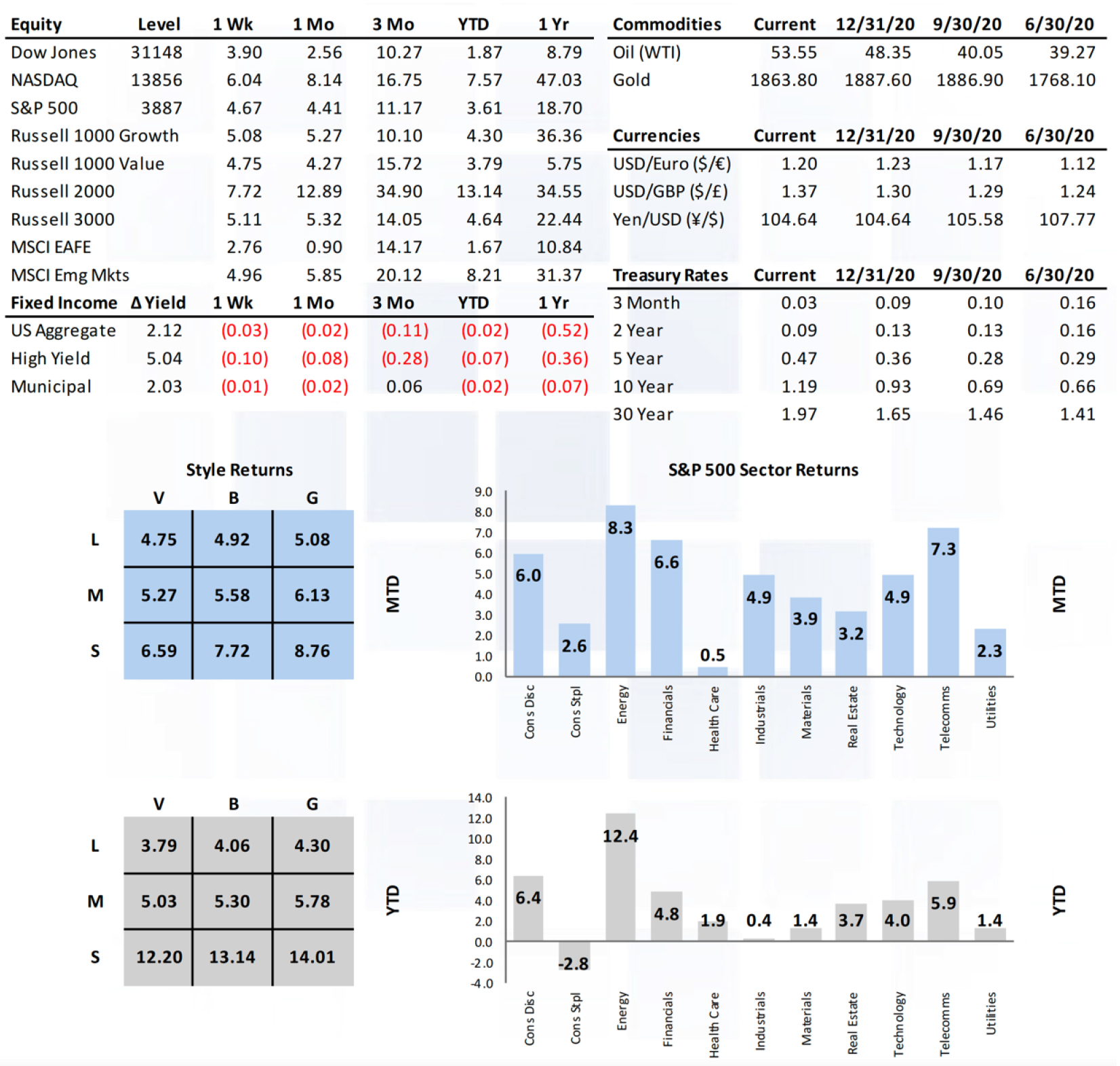

Market focus last week was the peak of the fourth quarter earnings season and a pretty heavy economic calendar. The S&P 500 (+4.65%) and R2000 (+7.7%) both returned to record high territory, quickly erasing the consolidation over the past week. With earnings season more behind us than in front, market attention will likely turn to policy developments and the intertwined nature of COVID progression and the trajectory of economic data.

Market Anecdotes

• Several high-profile earnings reports last week have brought us to the back half of the season and the positive results continued. Blended earnings per FactSet moved to positive territory at 1.7% and reported revenue of 2.7%.

• Energy stocks moved sharply higher again last week (+8.3%) and are the leading performers year to date (+12.2%) by a factor of 2.

• Democrats appear set on reconciliation in the Senate for the stimulus bill. The $600b Republican proposal was deemed ‘too small’ by Democrats.

• Senator Klobuchar introduced the first antitrust reform legislation last week which funds Fair Trade Committee and Department of Jobs enforcement and shifts the burden of proof from the government to the companies.

• The U.S. may see U.S. Treasury bill yields trade into negative territory, not due to policy rates but rather due to a temporary reduction in supply with a backdrop of consistently high demand.

• The Bank of Europe reduced 2021 growth forecasts from 7.25% to 5.0% but made no change to policy. While it made clear they have no plans to take rates to negative interest rate policy, they did instruct banks to begin preparations.

• The US dollar has been in rally mode since early January. The Bloomberg Dollar index has increased approximately 2% and reclaimed its 50-Day Moving Average in the process.

• Slow but improving CoVid-19 trends remained evident. U.S. daily vaccinated rate hit over 1.5mm last week. Global vaccinated rates are over 4.5mm. Extrapolating current trends may see over 65mm vaccinated by the end of March with herd immunity by Q320.

Economic Release Highlights

• The January employment report disappointed with payrolls rising less than half of expectations (49k vs 105k) but the unemployment rate falling more than expected (6.3% vs 6.7%).

• January Institute Supply Management (ISM) Manufacturing index of 58.7 registered just shy of the (red hot) consensus 60.0. January ISM Services index also came in at 58.7, handily above the 56.8 consensus.

• The final U.S. Purchase Manager’s Index (PMI) readings came in well above December levels and beat estimates for January.

• The JPM Global PMI index saw the composite and services fall slightly in January to 52.3 and 51.6 respectively while manufacturing improved to 53.5.

• January EU PMI came in slightly better than forecast but did soften from December’s level due to virus impacts. December EU retail sales increased 2%.

• Eurozone 4Q GDP contracted -0.7% quarter over quarter and by -5.1% year over year. Both indicators came in higher than the -1.7% and -6.0% forecasted consensus respectively.

W E E K E N D I N G 2 / 05 / 21

INSIGHT

MARKET ANALYSIS