All Three Large Cap Indicies Hit New Record Highs

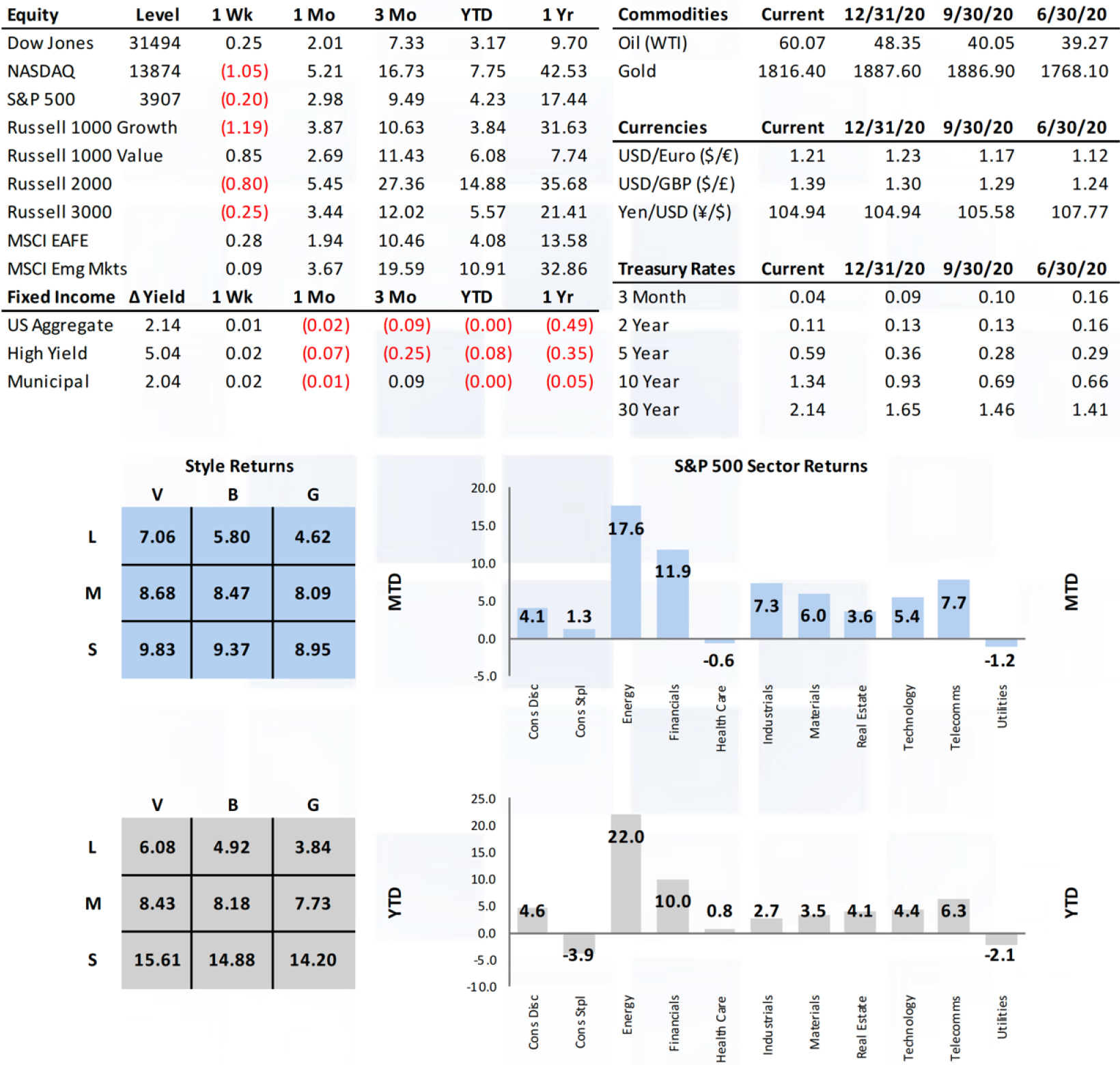

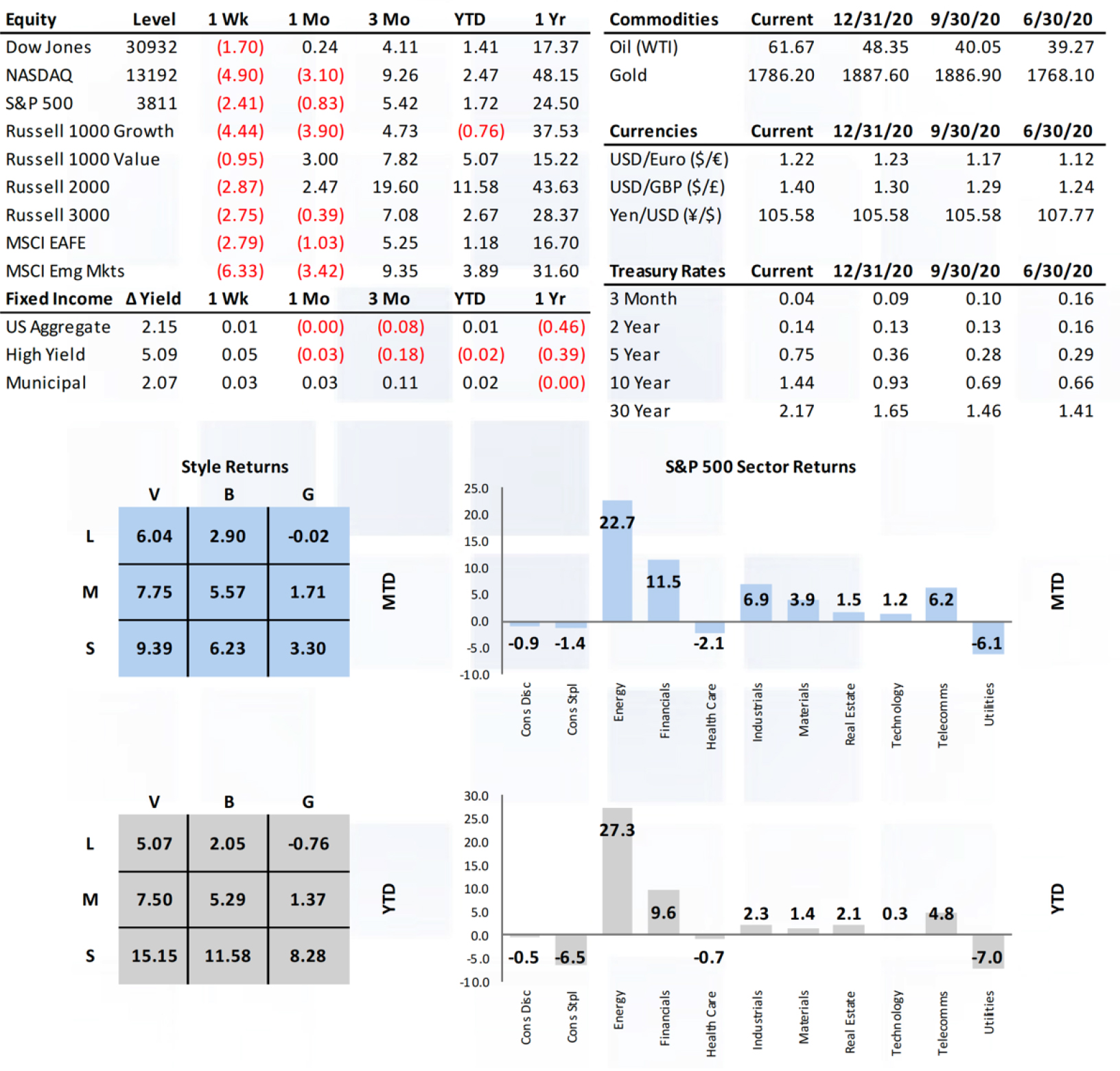

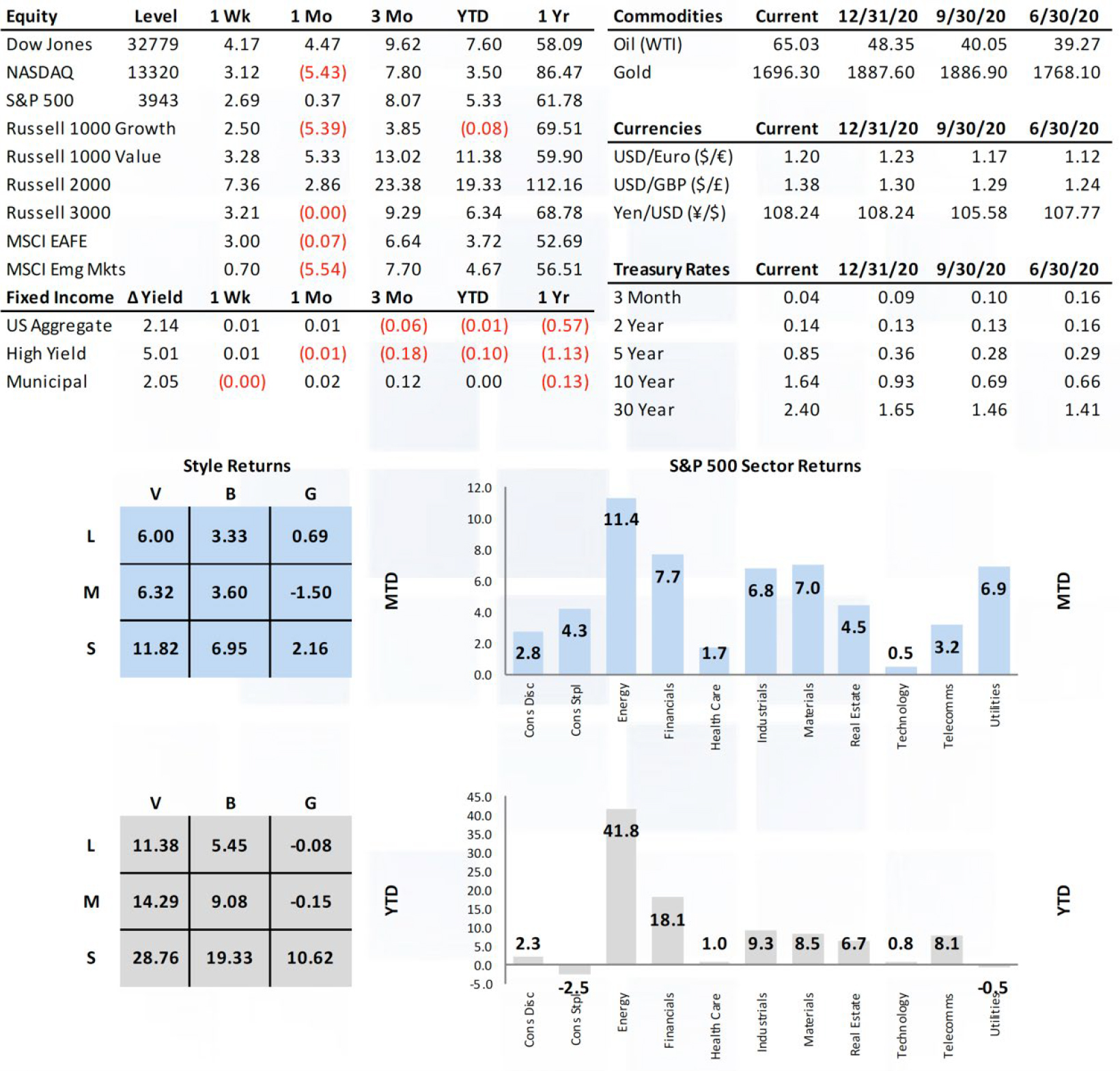

Primary drivers in the market last week included the signing of the American Recovery Act, exceptional progress on vaccine distribution, and a supportive calendar of economic reports. All three large cap U.S. indices (S&P, DJIA, NASDAQ) set new record highs while small caps surged over 7%. Gains were broad based with value/cyclicals continuing to lead the way, but we did see a strong bounce back in technology names as well. Developed and emerging international markets were up comparable to large cap U.S. markets. Both the USD and oil traded down slightly on the week. Rates moved higher in a similar fashion to recent weeks with the longer maturities rising 8 – 13 basis points and the short end remaining anchored by policy.

Market Anecdotes

•The $1.9t American Recovery Act became law last week, delivering a historic fiscal stimulus surge to many parts of the economy through stimulus checks, extended unemployment benefits, state & local government payments, Covid research/testing/vaccine distribution, and more.

•BCA Bank Credit Analyst noted consumers will have an estimated $2t in excess savings at their disposal by April and should begin seeping into the economy as activity normalizes.

•The economic impact of fiscal stimulus (particularly this size/scope) should be to increase aggregate demand. The unknown is how much the curve will shift and how much real slack there is to soak up in the overall economy.

•Strategas made the important point that the actual re-opening and recovery in mobility/activity is the real economic stimulus, far outweighing the American Recovery Act.

•The outperformance of financials over technology since September has been pronounced but somewhat muted due to the surge in ‘non-profitable’ tech company shares.

•The NASDAQ entered correction territory on Monday but bounced off what were likely some short-term oversold conditions the remainder of the week.

•The selling of Treasuries continued last week and, like last week, the focus was not inflation fears. The slope of the 10 year and 30 year was again pretty static but the 2 year 5 year steepened again.

•Currently markets expect the Fed to begin hiking rates in November 2022, another in May 2023, and again in November 2023 – notably more hawkish than the Fed’s current guidance.

•Arbor Data noted a significant part of the recent USD rally may be some short squeezes in addition to U.S. economic growth leading most non-U.S. markets.

•China’s annual National People’s Congress kicked off on Friday with the unveiling of economic targets and budgets for the year. Beijing noted GDP growth over 6%, 3% GDP, and unemployment similar to 2019 levels with a fiscal deficit target of 3.2% of GDP.

• The European Central Bank announced an increase to its Quantitative Easing scheme and left Pandemic Emergency Purchase Program (PEPP) unchanged at $2.21t until March 2022. European Union stocks rallied, and sovereign yields fell.

Economic Release Highlights

•February headline and core Consumer Price Index registered a benign 1.7% and 1.3% respectively.

•February NFIB Small Business Optimism registered 95.8, slightly below consensus but a small improvement over January.

•The flash University of Michigan consumer sentiment report for March came in significantly higher than expected, rising to 83.0 (78.5 expected) and up nicely from 76.8 in February.

• January Job Openings and Labor Turnover Survey (JOLTS) report has job openings at the highest levels since February 2020.

Investment Advisory Services are offered through Virtue Capital Management, LLC, an SEC Registered Investment Adviser. This newsletter is not to give investment advice. Before investing in any advisory product please carefully read any disclosure documents, including without limitation, the firm’s Form ADVs. Indices do not reflect the deduction of any fees or expenses. They are not available for direct investment. Exposure to an asset class represented by an index is available through investable instruments based on that index. The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the Nasdaq. The DJIA was designed to serve as a proxy for the broader U.S. economy. The Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. It is used as a broad-based market index. The S&P 500 index is designed to be a broad based unmanaged leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe or representative of the equity market in general. The Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. Total Return assumes dividends are reinvested. The Russell 1000 is a subset of the Russell 3000 Index. It represents the top companies by market capitalization. The Russell 1000 measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 index is an index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States. Visit www.russell.com/indexes/ for more information regarding Russell indices. The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. Nothing contained herein constitutes financial, legal, tax, or other advice. These opinions may not fit your financial status, risk and return profile or preferences. Investment recommendations may change, and readers are urged to check with their investment adviser before making any investment decisions. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns or results. No representation is made as to the accuracy, completeness or timeliness of the information in this material since certain information herein is based on or derived from information provided by independent third-party sources. All enclosed material including market analysis data provided Taiber Kosmala & Associates, LLC. There is no duty to update this information. The Wilshire 5000 Total Market Index represents the broadest index for the U.S. equity market, measuring the performance of all U.S. headquartered equity securities with readily available price data. The PHLX Semiconductor Sector Index (SOX) is a capitalization-weighted index composed of 30 semiconductor companies. The companies in the Index have primary business operations that involve the design, distribution, manufacture and sale of semiconductors. The index is designed to track the performance of listed semiconductors. The Case-Shiller Index, formally known as the S&P/Case-Shiller Home Price Index is made up of several indexes that track the value of single-family detached residences using the arms-length and repeat-sales methods. It is used as a barometer not just of the housing market, but also of the health of the broader economy. For more information on the index, please visit https://www.spglobal.com/. All information obtained from Taiber Kosmala & Associates (2020. The secured overnight financing rate (SOFR) is a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the London interbank offered rate (LIBOR). Interest rate swaps on more than $80 trillion in notional debt switched to the SOFR in October 2020.