HORTER INVESTMENT MANAGEMENT, LLC

Weekly Commentary horterinvestment.com February 11, 2019

The fate of the market this year could be in the hands of the ‘Powell Put’

Call it the “Powell Put” or the “Powell Pivot” or something else, but the Federal Reserve chairman’s recent change in approach to monetary policy is reverberating through the markets.

In just a matter of a few months, central bank chief Jerome Powell has evolved from a hawk on interest rates — in favor of pushing them higher — to a seeming dove intent at the very least on waiting to see how conditions evolve before making another move.

Before running into some trouble at the end of this week, the market appeared to be rallying at least in part on a more accommodative Fed.

With a multitude of headwinds still brewing — anticipated negative earnings growth in the first quarter is just the latest — the big question will be how far Powell and his fellow policymakers will be able to carry the markets with their stated intention to be “patient” about future tightening.

“This clearly feels like the market probably overreacted to his hawkishness in October, and we’re probably overreacting to to his dovishness in January and February,” said Art Hogan, chief market strategist at National Holdings. “I would characterize it not as a Powell put, but as a Powell pause.”

After climbing to start 2019, the stock market comeback is on hold – here’s why

The Dow Jones Industrial Average clinched its first three day loss of 2019 on Friday and there are a few key reasons the stock market’s recent rally has slowed.

The Dow and S&P 500 indexes each climbed over 7 percent in the past six weeks, but the rally in U.S. stocks has paused. The Dow was headed for its first negative week of the year but narrowly eked out an 0.17 percent gain after a late rally on Friday afternoon.

Here are the three major reasons:

1. A negative earnings outlook: After many stocks rallied during the best quarterly earnings season in nine years, investors began looking at the current quarter and the year ahead — and the 2019 outlook is not great. Wall Street analysts are slashing earnings expectations for the first quarter of 2019 so sharply that the overall estimate of profit growth for the period just turned negative. Earnings are now expected to fall on average by 0.8 percent, according to FactSet. That’s quite a reversal from September, when analysts expected profits to jump nearly 7 percent. Blame poor company outlooks accompanying the strong fourth-quarter numbers.

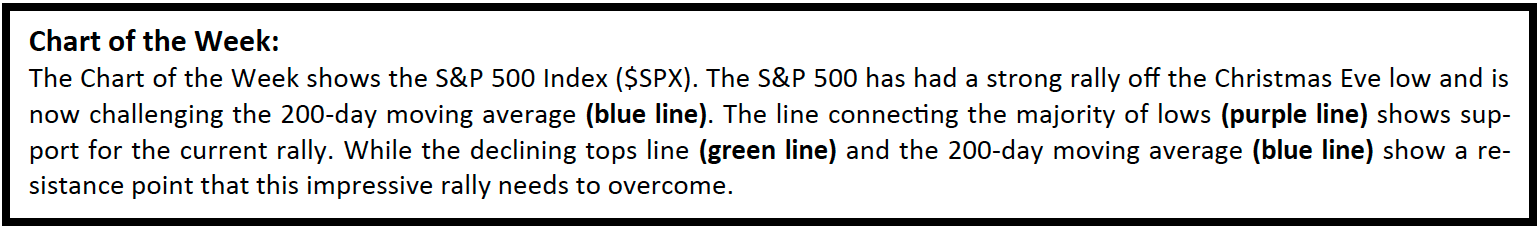

Taking a comprehensive look at the overall current stock market

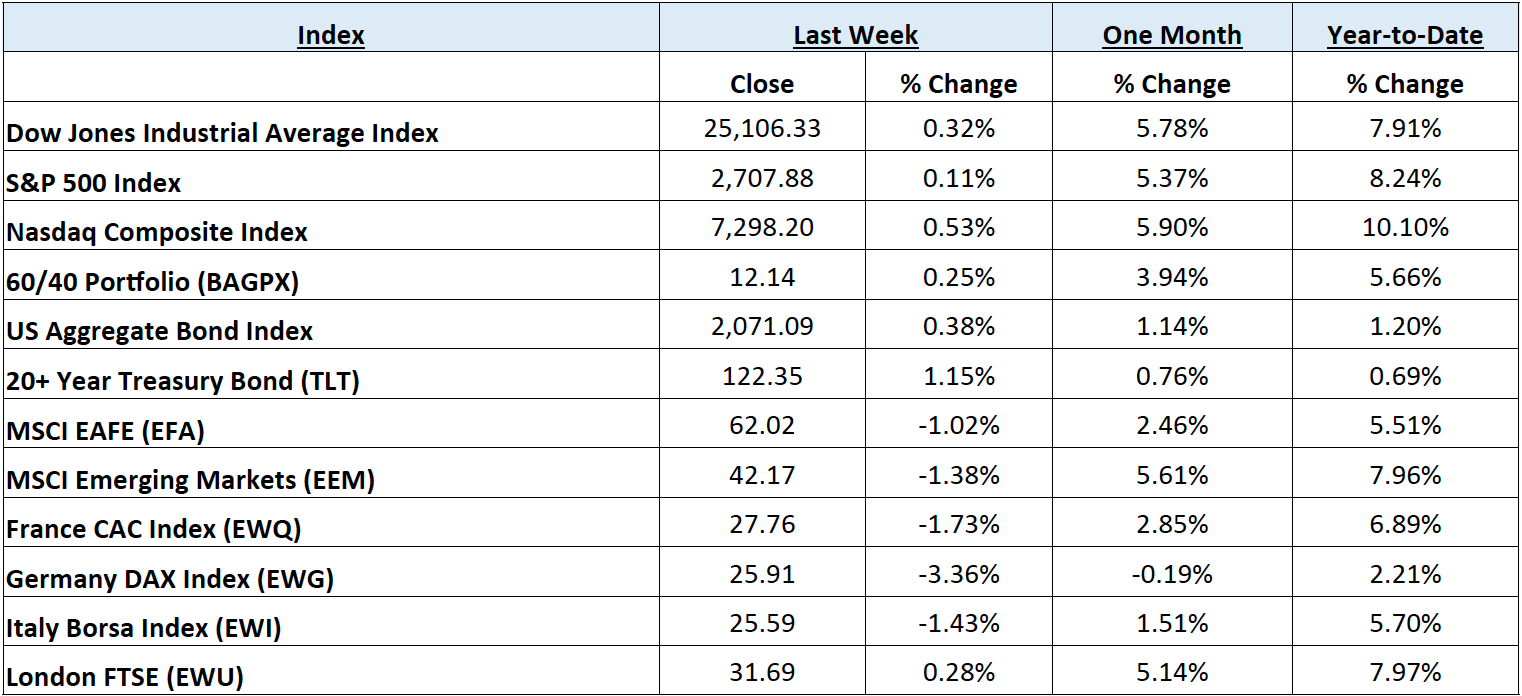

Taking a comprehensive look at the overall current stock market, you can see the chart below representing eight major indices and their returns through the week ending February 8, 2019. In a truly diversified portfolio, the portfolio’s total return is determined by the performance of all of the individual positions in combination – not individually.

So, understanding the combined overall performance of the indices below, simply average the 12 indices to get a better overall picture of the market. The combined average of all 12 indices is 5.84% year to date.

Data Source: Investors FastTrack, Yahoo Finance, Investopedia

Past performance is not a guarantee of future results. This Update is limited to the dissemination of general information pertaining to its investment advisory services and is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock and bond markets involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice. Horter has experienced periods of underperformance in the past and may also in the future. The returns represented herein are total return inclusive of reinvesting all interest and dividends.

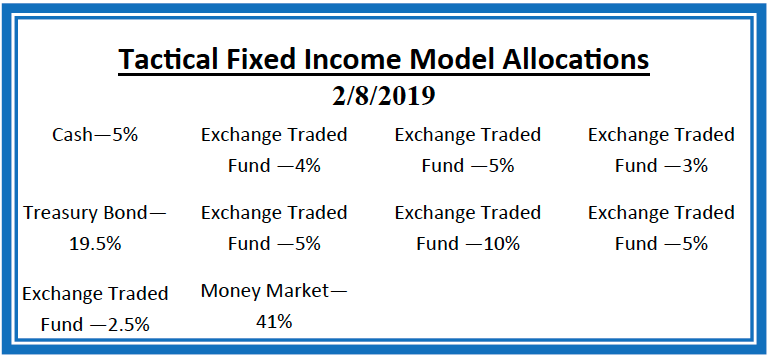

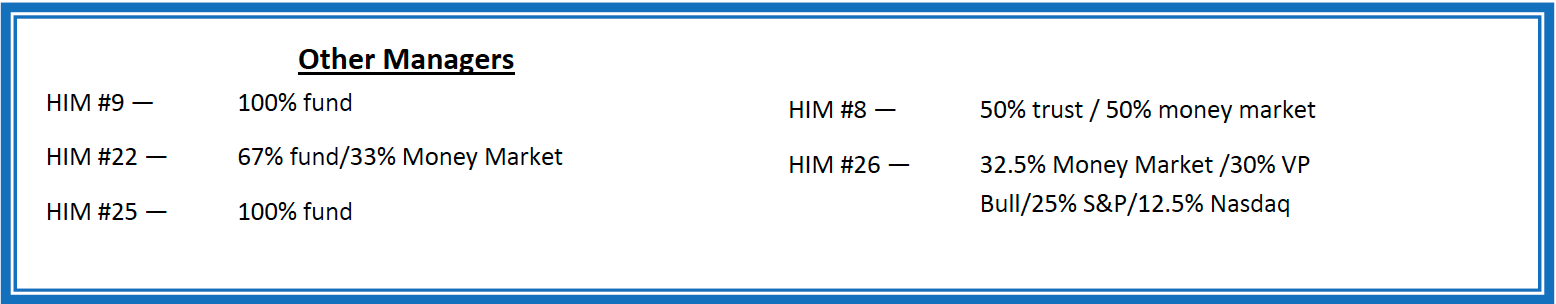

The above equity, bond and cash weightings are targets and may not be the exact current weightings in any particular client account. Specifically, there may be cases where accounts hold higher cash levels than stated in these target weightings. This is usually to accommodate account level activity. Furthermore, some variable annuity and variable universal life accounts may not be able to purchase the exact weightings that we are indicating above due to specific product restrictions, limitations, riders, etc. Please refer to your client accounts for more specifics or call your Horter Investment Management, LLC at (513) 984-9933.

Investment advisory services offered through Horter Investment Management, LLC, a SEC-Registered Investment Advisor. Horter Investment Management does not provide legal or tax advice. Investment Advisor Representatives of Horter Investment Management may only conduct business with residents of the states and jurisdictions in which they are properly registered or exempt from registration requirements. Insurance and annuity products are sold separately through Horter Financial Strategies, LLC. Securities transactions for Horter Investment Management clients are placed through E*TRADE Advisor Services, TD Ameritrade and Nationwide Advisory Solutions.

For additional information about Horter Investment Management, LLC, including fees and services, send for our disclosure statement as set forth on Form ADV from Horter Investment Management, LLC using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

Dow Jones – Week Ending

WEEKLY MARKET SUMMARY

Global Equities: Global equities pulled back in weekly trading, after data showed slower-than-expected global growth and the deadline for a US-China trade deal ticked closer with no substantial progress. US indices were relatively flat for the week while developed international and emerging markets were both down more than -1%. Optimism over a trade deal had been rising in recent weeks, however, reports that President Trump and Chinese President Xi Jinping are unlikely to meet before the March 1st trade deadline caused investors to reign in expectations. There is still a possibility that President Trump pushes back the March 1st deadline, when tariffs were due to jump from 10% to 25%, but White House economic adviser Larry Kudlow’s statement that that the US and China still have “miles to go” added to the uncertainty.

Fixed Income: The yield on the 10-year Treasury Note eased slightly to 2.63%, down 5 basis points from the week prior. Home buyers have found favorable terms thus far in 2019, as the average 30-year fixed-rate mortgage averaged 4.41%, over 50 basis points lower than last November, when rates were averaging just under 5%. High yield bond mutual funds and ETFs pulled in $3.86 billion in the weekly period ended February 6th, the largest weekly inflow since July 2016. High yield bonds are off to a blistering start in 2019, with the lowest credit quality CCC-rated bonds leading the way. After zero issuance in December, borrowers are back in force, as evidenced by a $2.235 billion issuance from Clear Channel Outdoor Holdings Inc., the largest CCC-rated deal since September.

Commodities: Crude oil declined in weekly trading, with US Benchmark West Texas Intermediate falling from $55.26 to $52.71 as of Friday afternoon. Weekly domestic crude inventories rose 1.3 million barrels to 447.2 million, 6.4% more than a year ago. Clashes near Libya’s largest oil field put upward pressure on prices, however larger concerns over slowing global growth ultimately pushed crude lower. Natural gas prices were also lower, to close the week at $2.59/MMBtu.

WEEKLY ECONOMIC SUMMARY

Eurozone Weakness Persists: The bad news out of the Euro-zone keeps coming, with the latest being a sharp downward revision to 2019 growth forecasts. Eurozone policymakers now foresee annual growth of just 1.3%, down from prior forecasts of 1.9%. Lessening Chinese demand coupled with the Brexit debacle are largely to blame for the slowdown. With Italy already in recession and Germany at risk, plus the potentially catastrophic outcome of a no-deal Brexit, the outlook for the region in whole continues to deteriorate.

Powell Optimistic: Fed Chairman Jerome Powell met with President Trump and Secretary of the Treasury Steven Mnuchin for a dinner discussion over the state of the economy, and also hosted a town hall meeting at the Federal Reserve building in Washington DC. Chairman Powell offered an upbeat view of the economy, citing the strength of the labor market, on-track inflation, and the evident resiliency of the economy thus far to market stressors such as the Brexit uncertainty. Taking a longer-term view, Chairman Powell singled out the widening wage gap as one of the biggest challenges facing the US over the coming decade, as wages for top earners have grown much more rapidly than those of middle and lower level workers.

Q4 Earnings Season: The week kicked off with Google-parent Alphabet (GOOG) beating expectations on both revenue and earnings, but shares declined as investors keyed in on shrinking margins. British oil giant BP (BP) reaped the benefits of US shale acquisitions, with record utilization driving revenue to a five-year high, sending shares over 3% higher. Social media companies had mixed results, with Twitter (TWTR) shares falling nearly -10% on shrinking revenues and declining monthly users. Meanwhile, shares of Snap (SNAP) surged over 20% after the maker of the Snapchat messaging app reported a less-than-expected loss and keeping monthly users flat following two consecutive quarters in which the userbase shrank.

Current Model Allocations

Summary

In utilizing an approach that seeks to limit volatility, it is important to keep perspective of the activity in multiple asset classes. We seek to achieve superior risk-adjusted returns over a full market cycle to a traditional 60% equities / 40% bonds asset allocation. We do this by implementing global mandates of several tactical managers within different risk buckets. For those investors who are unwilling to stomach anything more than minimal downside risk, our goal is to provide a satisfying return over a full market cycle compared to the Barclays Aggregate Bond Index. At Horter Investment Management we realize how confusing the financial markets can be. It is important to keep our clients up to date on what it all means, especially with how it relates to our private wealth managers and their models. We are now in year nine of the most recent bull market, one of

the longest bull markets in U.S. history. At this late stage of the market cycle, it is extremely common for hedged managers to underperform, as they are seeking to limit risk. While none of us know when a market correction will come, even though the movement and volatility sure are starting to act like a correction, our managers have been hired based on our belief that they can accomplish a satisfying return over a full market cycle, – while limiting risk in comparison to a traditional asset allocation approach. At Horter we continue to monitor all of the markets and how our managers are actively managing their portfolios. We remind you there are opportunities to consider with all of our managers. Hopefully this recent market commentary is helpful and thanks for your continued trust and loyalty.