HORTER INVESTMENT MANAGEMENT, LLC

Weekly Commentary horterinvestment.com May 14, 2018

US National Debt Spiraling Out of Control, New Record

1. Treasury Borrowing Hit Record $488 Billion in 1Q

2. Why Deficits Could be Worse Than the CBO’s Estimates

3. Trillion Dollar Deficits to Become the “New Normal”

4. When It Comes to Debt, US Stands Alone in Developed World

Treasury Borrowing Hit Record $488 Billion in 1Q

The Treasury Department announced last week that the government borrowed a record $488 billion in the January-March quarter. The Treasury said that actual borrowing in the 1Q exceeded the old record of $483 billion set in the first quarter of 2010 – the period when the country was struggling to pull out of a deep recession and prop-up the financial system following the 2008 financial crisis.

What makes the just passed quarter particularly troubling is that there was no crisis, no major alarming events and not even a recession. In fact, in the first quarter US GDP rose by 2.3% according to the Commerce Department amid what experts said was a global coordinated recovery.

President Trump’s tax cuts, the two-year budget deal that led to higher spending caps for this year and next and the $1.3 trillion fiscal 2018 omnibus spending bill are the main contributors to the worsening fiscal picture compared to last year. In addition, several rounds of supplemental appropriations for the relief efforts after three major hurricanes in 2017 have contributed to the bloated federal spending this year.

What is scary is how fast the US is ramping up federal debt. In the first six months of the fiscal year, October 2017-March 2018, the US budget deficit rose to $600 billion as spending increased at three times the pace of revenue growth. If that growth rate were to continue, the US deficit would soar to $1.2 trillion for FY2018.

Jamie Dimon: Economy is ‘strong’ but odds for another recession are ‘100 percent’

- J.P. Morgan Chase CEO Jamie Dimon is optimistic on the state of the economy — for now.

- “America looks pretty good. … It looks like this [economic growth] may have legs to go. Maybe a year, maybe two, maybe more,” he tells Bloomberg Television.

J.P. Morgan Chase Chairman and CEO Jamie Dimon thinks the U.S. economy is doing well for now.

“America looks pretty good. … It looks like this [economic growth] may have legs to go. Maybe a year, maybe two, maybe more,” Dimon said in an interview Monday on Bloomberg Television from Beijing.

Dimon cited the strong job numbers, the lower level of leverage in the financial system, and consumer and bank liquidity as positive signs for growth. He noted the shortage in housing supply, which will likely lead to more economic activity. Dimon said economic growth in other countries in Asia and Europe is improving.

But he also cautioned that the good times will not last forever.

“Someone asked me once, what’s the odds of a recession? I said it’s 100 percent. But the question is when. Right now the American economy in a very broad-based way is strong,” he said.

On another matter, Dimon is optimistic that trade negotiations between the U.S. and China will have a positive outcome.

“Make it a win-win for everybody. I think it’s achievable,” he said.

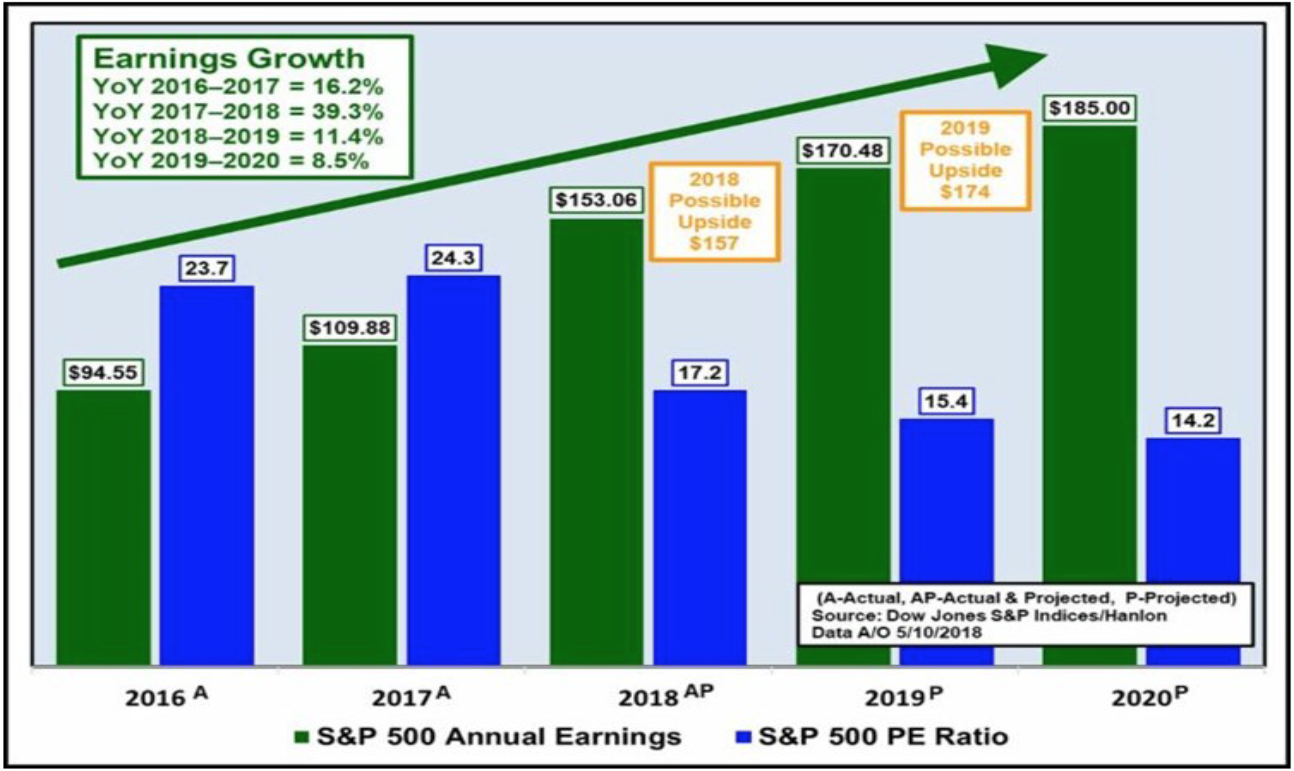

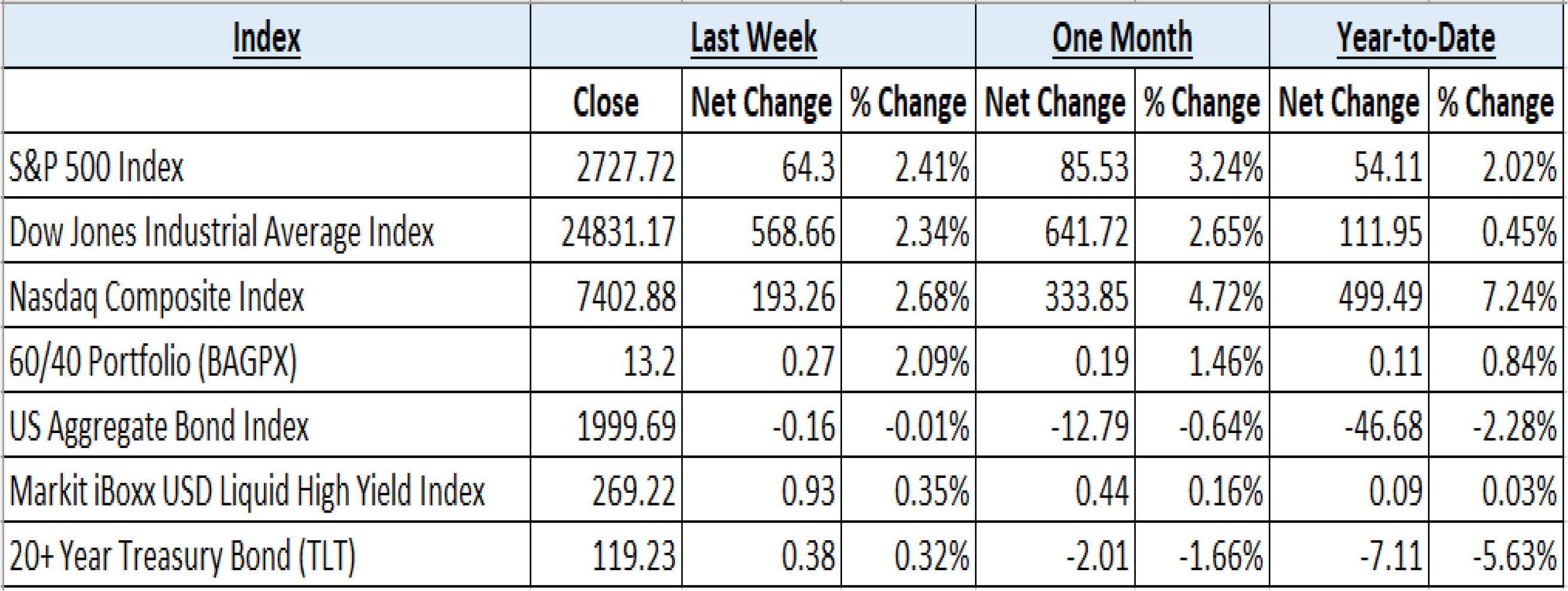

Taking a comprehensive look at the overall current stock market

Taking a comprehensive look at the overall current stock market, you can see the chart below representing eight major indices and their returns through the week ending May 11, 2018. In a truly diversified portfolio, the portfolio’s total return is determined by the performance of all of the individual positions in combination – not individually.

So, understanding the combined overall performance of the indices below, simply average the 7 indices to get a better overall picture of the market. The combined average of all 7 indices is 2.67% year to date.

Data Source: Investors FastTrack, Yahoo Finance

Past performance is not a guarantee of future results. This Update is limited to the dissemination of general information pertaining to its investment advisory services and is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock and bond markets involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice. Horter has experienced periods of underperformance in the past and may also in the future. The returns represented herein are total return inclusive of reinvesting all interest and dividends.

The above equity, bond and cash weightings are targets and may not be the exact current weightings in any particular client account. Specifically, there may be cases where accounts hold higher cash levels than stated in these target weightings. This is usually to accommodate account level activity. Furthermore, some variable annuity and variable universal life accounts may not be able to purchase the exact weightings that we are indicating above due to specific product restrictions, limitations, riders, etc. Please refer to your client accounts for more specifics or call your Horter Investment Management, LLC at (513) 984-9933.

Investment advisory services offered through Horter Investment Management, LLC, a SEC-Registered Investment Advisor. Horter Investment Management does not provide legal or tax advice. Investment Advisor Representatives of Horter Investment Management may only conduct business with residents of the states and jurisdictions in which they are properly registered or exempt from registration requirements. Insurance and annuity products are sold separately through Horter Financial Strategies, LLC. Securities transactions for Horter Investment Management clients are placed through TCA by E*TRADE, TD Ameritrade and Nationwide Advisory Solutions.

For additional information about Horter Investment Management, LLC, including fees and services, send for our disclosure statement as set forth on Form ADV from Horter Investment Management, LLC using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

Dow Jones – Week Ending

WEEKLY MARKET SUMMARY

Global Equities: All three major US equity indices finished with solid gains after breaking out to the upside of a technical trend of lower highs. The Nasdaq Composite led the S&P 500 and the Dow Jones Industrial Indexes, finishing the week with gains near 2.7%, 2.4%, and 2.3%, respectively. The historically defensive Utilities sector lagged all sectors for the week while the Energy sector led all other S&P sectors thanks to Middle-East turmoil boosting oil prices. Emerging Market equities recovered after a volatile previous couple of weeks, as the iShares MSCI Emerging Markets Index ETF (EEM) gained over 2%.

Fixed Income: The recurring weekly theme of the yield on the US 10-Year Treasury Note testing the 3% level mid-week held true, but again failed to sustain before falling to 2.97% to close the week higher than the previous week’s ~2.95%. Treasury term-premium yield spreads, the extra yield paid for longer dated bonds, continued to tighten to levels not seen since 2007. The spread between the 10-year and the 2-year narrowed to just .27% from .33% the prior week. High-yield debt funds recorded outflows as their corresponding spreads over risk-free securities tightened for the week. The iShares IBoxx High-Yield Corporate Bond ETF (ticker: HYG) ended the week up roughly .4%.

Commodities: President Trump confirmed expectations on Tuesday that he would indeed be withdrawing from the Iran nuclear deal agreed to under President Obama. While this news was largely priced in to the oil markets, Middle-East tensions escalated quickly when Israeli missiles struck several Iranian military installations in Syria. The attack came after Israel accused Iran of sending rockets into the Israeli occupied Golan Heights region. Oil markets may be in for a volatile ride should tensions escalate or, conversely, if European nations ignore the sanctions and continue to do business with Iran. Brent Crude ended the week near $77 per barrel, while the American West Texas Intermediate price increased to around $70.60 per barrel. Natural Gas prices ended the week higher by over 3%, to $2.81/MMBtu.

WEEKLY ECONOMIC SUMMARY

Consumer Price Index (CPI): Spurred by a 3% month-on-month (MoM) rise in gasoline prices, the headline CPI number was in-line with consensus expectations at a 2.5% increase year-on-year (YoY). The measured core component, less food and energy, was slightly under estimates at .1% MoM and 2.1% YoY as some consumer goods including new and used vehicle prices helped offset increased prices for shelter and medical services. This core measure will continue to be watched closely as the labor market continues to tighten, and because much of the effect from vehicle pricing was influenced by the drop in post-hurricane demand.

Consumer Sentiment: The preliminary University of Michigan Consumer Confidence survey was unchanged for this month, from the already-high prior level of 98.8. A slight drop in the current conditions index, likely due to higher gas prices, was undone by an increase in the consumer expectations index. This likely forebodes a rebound in consumption growth, the largest component of GDP growth, with tax cuts hopefully boosting disposable incomes.

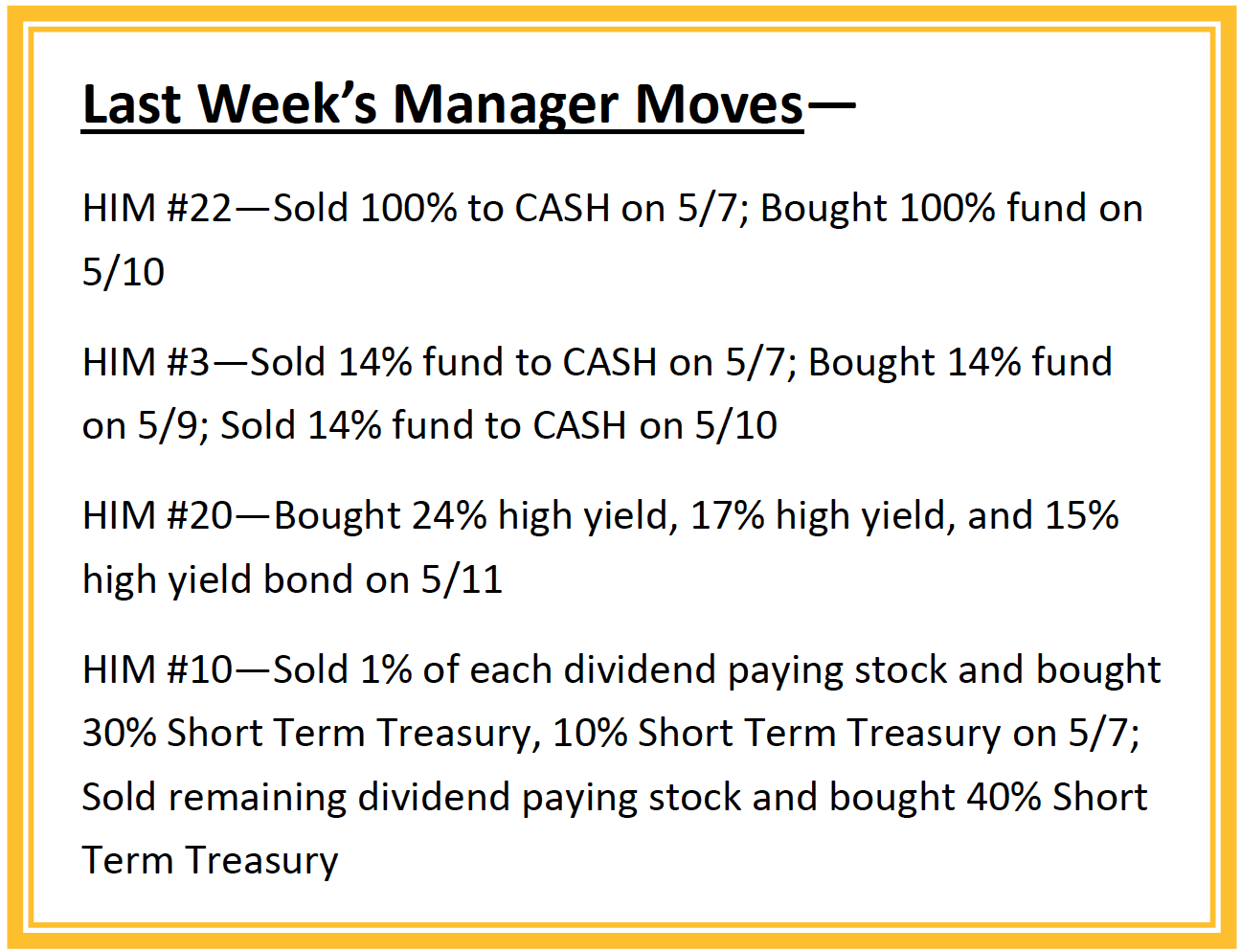

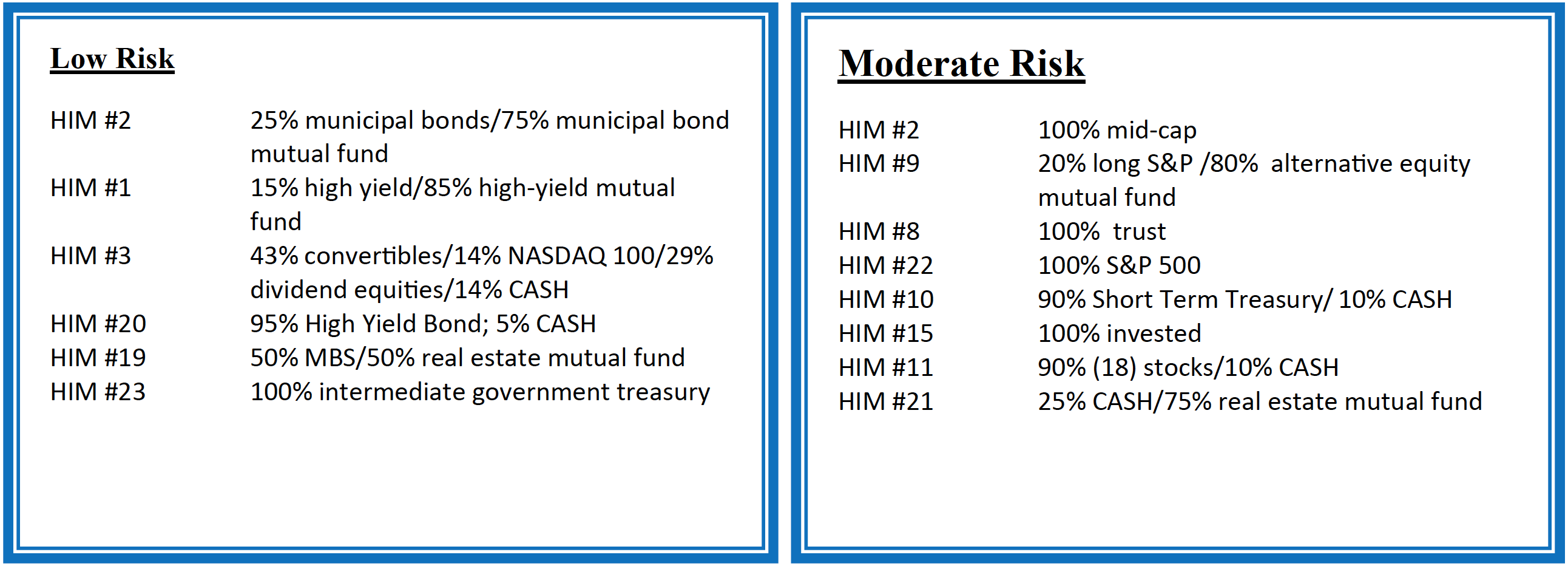

Current Model Allocations

Summary

In utilizing an approach that seeks to limit volatility, it is important to keep perspective of the activity in multiple asset classes. We seek to achieve superior risk-adjusted returns over a full market cycle to a traditional 60% equities / 40% bonds asset allocation. We do this by implementing global mandates of several tactical managers within different risk buckets. For those investors who are unwilling to stomach anything more than minimal downside risk, our goal is to provide a satisfying return over a full market cycle compared to the Barclays Aggregate Bond Index. At Horter Investment Management we realize how confusing the financial markets can be. It is important to keep our clients up to date on what it all means, especially with how it relates to our private wealth managers and their models. We are now in year nine of the most recent bull market, one of

the longest bull markets in U.S. history. At this late stage of the market cycle, it is extremely common for hedged managers to underperform, as they are seeking to limit risk. While none of us know when a market correction will come, even though the movement and volatility sure are starting to act like a correction, our managers have been hired based on our belief that they can accomplish a satisfying return over a full market cycle, —while limiting risk in comparison to a traditional asset allocation approach. At Horter we continue to monitor all of the markets and how our managers are actively managing their portfolios. We remind you there are opportunities to consider with all of our managers. Hopefully this recent market commentary is helpful and thanks for your continued trust and loyalty.